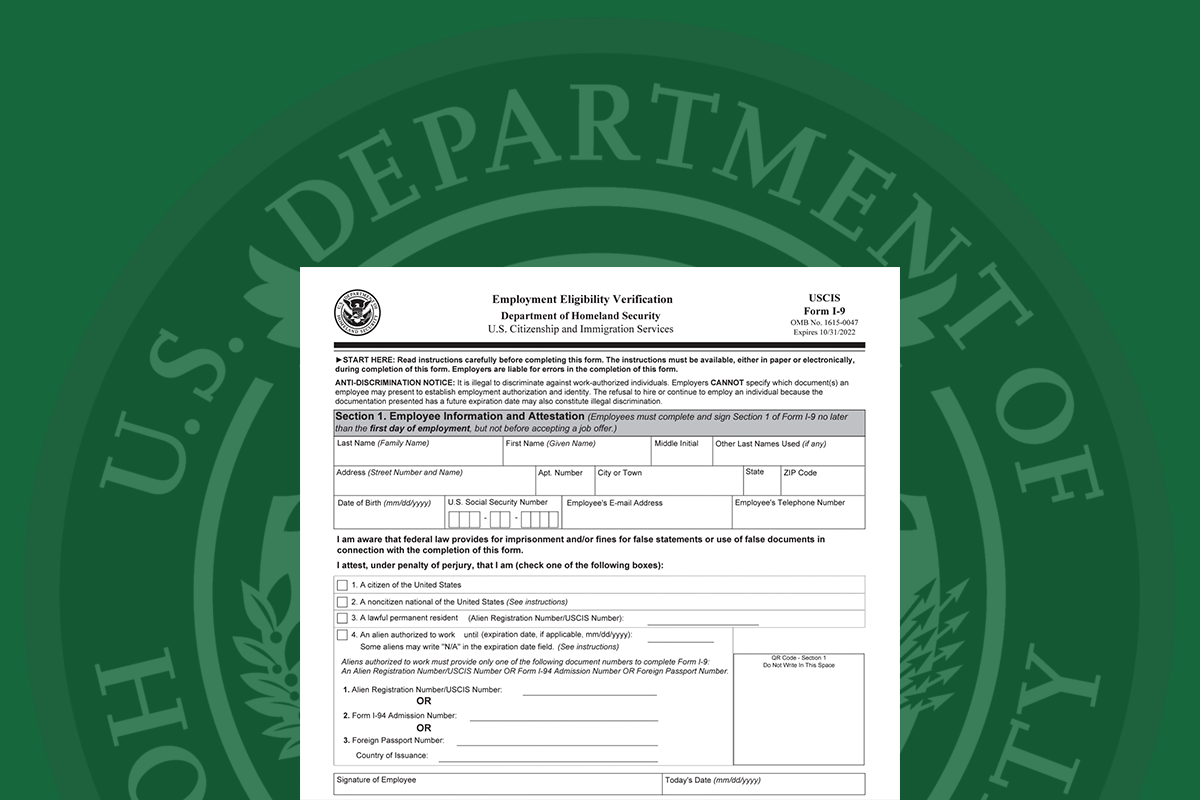

Form I-9 is a government form used to verify an employee's identity and legal right to work in the United States. It is issued by the United States Citizenship and Immigration Services (USCIS). When you hire a new employee, you have three days to complete the form and review the required verification documents.

Completing the Form I-9 and verification process accurately ensures that you don't hire illegal workers inadvertently, thus protecting your company from government fines and lawsuits. Keep in mind that even if your employees are legally permitted to work in the United States, filing inaccurate or incomplete I-9 forms can result in serious consequences.

Here are seven tips to follow in order to meet this federal requirement and maintain a compliant, organized process.

1. Always Use The Most Recent Form I-9.

You can find the edition date at the bottom of the page on the form and instructions. At the time of this article, you should use the Form I-9 with the date 10/21/19 in the bottom left corner for all new hires.

2. Pay Attention To The Finer Points.

If you leave out basic information like your business name or address, you could be fined. Simple errors can be costly and range anywhere from hundreds to even thousands of dollars per violation. If you discover any errors after a form has been completed (weeks, months, or years later), correct the errors and initial and date the change.

3. Double-check That You Have A Form I-9 On File For Each Member Of Your Team.

You must keep the Form I-9 for three years after the employee's hire date or one year after the employee's last day of work with your company, whichever comes first. Simply put, this means that all current employees, as well as those who have recently left the company, should have an I-9 on file according to record retention rules. Note: even if you know the person is a U.S. citizen, you still must have a Form I-9 on file.

4. File Form I-9 Copies Together.

No matter how or where you store your Form I-9 documents, make sure that they are accessible in the event of an audit. You will be required to present them to government officials within 3 days of the date on which the forms were requested. Storing your I-9s separately from other records helps limit your exposure in an audit or investigation.

5. Photocopies Should Not Be Kept.

Employees' employment eligibility documents are not required to be kept on file (such as their Social Security cards, etc). In fact, the majority of employment law attorneys advise against it. If you decide to keep copies, make sure you do so for each employee so that your process is consistent. You may choose to begin or end the practice of keeping copies of documentation at any time, as long as you do so for all employees and as long as you do not destroy previously retained copies of documentation.

6. Audit Your I-9 Forms On A Regular Basis.

In the event of an I-9 audit, a self-audit can go a long way toward lowering fines. It is estimated that 20-40% of all Form I-9s have one or more errors. An audit's main goals are to correct errors, discard records that are no longer needed, and, most importantly, ensure that you are not employing an undocumented worker.

7. Use CIC's Employment Screening System to Manage the I-9 Process

When you use CIC's employment screening system, the process of managing and submitting a Form I-9 is made easier for both you and the new employee, with built-in fail-safes that prevent you from proceeding to the next step if previous steps are not correctly completed.

Our system will automate the process, saving you time, ensuring compliance, and preparing your new employee for day one.

Schedule a time to let us walk you through the steps to complete and manage your Form I-9 process and learn how our automated system will benefit your company.

For more information about this article, or general Employment Screening Services, please contact us at 1.800.573.2201 / 419.874.2201.