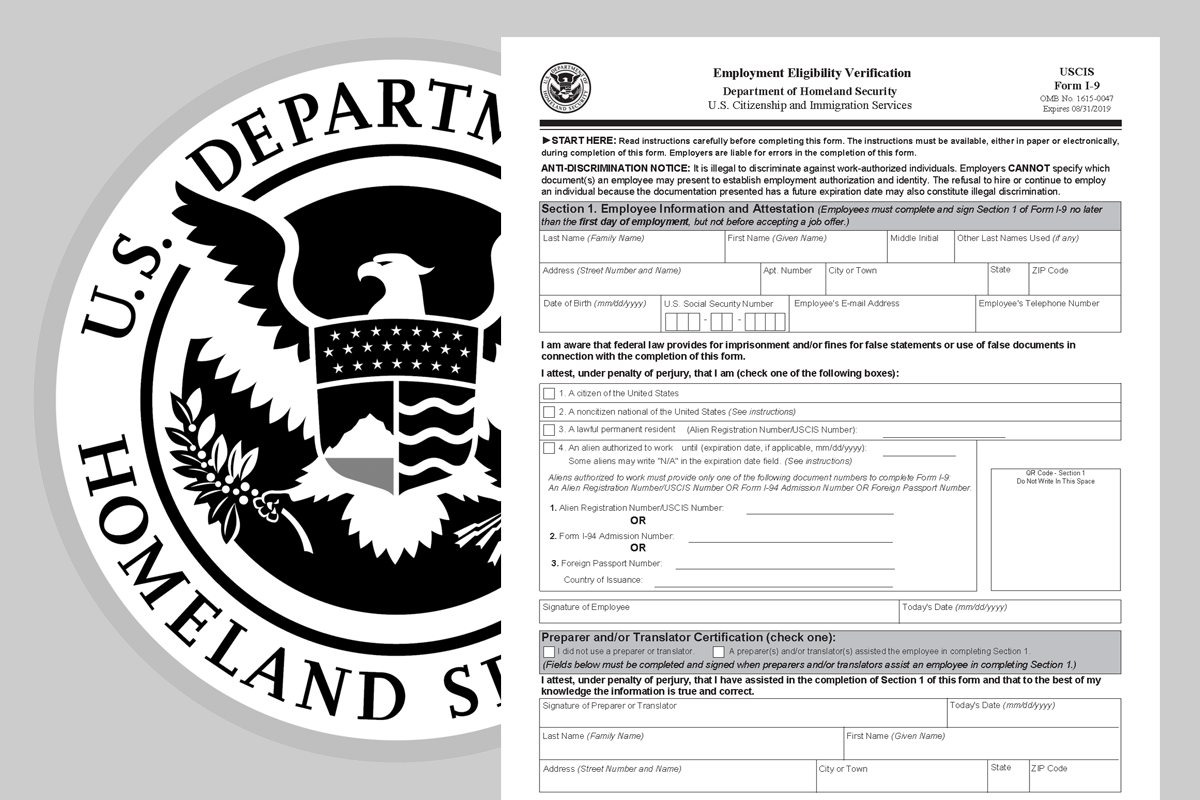

Since November 6, 1986, employers have been tasked with completing and retaining Form I-9, Employment Eligibility Verification, for every person they hire for employment in the U.S. provided that person works for pay or other type of payment ...

Shortly after that, DHS started conducting audits of employers' Form I-9s and levying fines for missing information, incorrect information, and no information at all.

Tips to Manage Your Form I-9 Program

Here are some tips to manage, organize, and store Form I-9s and all relevant supporting documentation:

No matter how or where you store your Form I-9 documents, make sure that they are accessible in the event of an audit. (You will be required to present them to government officials within 3 days of the date on which the forms were requested.)

Form I-9s can be stored in their original paper form, on microfilm or microfiche, or electronically.

Form I-9 regulations allow employers to choose whether or not to keep copies of documentation employees submit to complete Form I-9. Therefore, you may choose to begin or end the practice of keeping copies of documentation at any time, as long as you do so for all employees, regardless of national origin or citizenship status, or you may be in violation of anti-discrimination laws. If you change your policy and choose not to keep copies of documentation going forward, you should not shred the previously retained copies of documents. DHS regulations provide that, once copies of documents are made, they must be retained with the Form I-9 or with the employee’s records.

The instructions and the Lists of Acceptable Documents page must be made available to all employees completing the form. You do not need to provide a copy of the instructions for employees to keep, but you must provide a copy that they can refer to while completing the Form I-9.

Employees must complete every applicable field in Section 1 of the Form I-9 with the exception of the fields requesting the employees’ telephone number, e-mail address, and Social Security number. However, an employee must enter his or her Social Security number if the employer participates in E-Verify.

Employers are not expected to be document experts. Employers may reject a document presented by an employee if the document does not reasonably appear to be genuine or to relate to the person presenting it and ask for another acceptable document.

For more answers to Frequently Asked Questions about Form I-9 requirements and policies, visit:

Start Using Our Employment Screening System to Automate the Process and Remain Compliant

It is estimated that 20-40% of all Form I-9s have one or more errors — a costly mistake for employers if audited. CIC can help you stay on the right side of an audit with our Electronic I-9.

When you use CIC's employment screening system, the process for managing and submitting a Form I-9 is made easier for both you and the new employee.

You and your new employee will be guided through the completion of each step of the Form I-9. There are failsafes in place so that you will not be able to proceed to the next step without completing the previous step.

Some basic benefits are:

- One-click setup

- Electronically submitted

- Integrated with optional E-Verify

- Compliant PDF to store electronically or print and file

- Monitoring of document expiration dates

- Maintain a legal workplace

- Applicant is ready on day one

CIC is offering a Mini HR Clinic to walk you through the steps to manage Form I-9 and show you how our employment screening system will automate the process to save you time, keep you compliant, and prepare your new employee for day one.

SCHEDULE NOWFor more information about this article, or general Employment Screening Services, please contact us at 1.800.573.2201 / 419.874.2201.